Smart budgeting often includes selecting credit cards that match a person’s purchasing habits, and that principle applies strongly to frequent shoppers who turn to one of the largest retailers worldwide.

Walmart is a one-stop shop that appeals to customers seeking value and convenience. Shoppers can benefit from Walmart’s credit card options, earning cashback, accessing special financing, and enjoying additional perks for everyday transactions.

This guide explains how to apply for a Walmart Credit Card online, outlining key details on eligibility, interest rates, and how to manage the card wisely.

Purpose of a Walmart Credit Card

Many individuals worldwide rely on Walmart for groceries, clothing, household essentials, electronics, etc. A dedicated credit card can streamline payments and deliver rewards that add value to day-to-day shopping.

Walmart offers two main credit card choices, each tailored to different spending behaviors. Proper selection can yield savings through higher cashback returns on specific categories.

The Global Reach of Walmart

The Walmart brand spans numerous regions, serving millions of customers in physical stores and online platforms. It carries products that meet various household needs, from budget-friendly groceries to major electronics.

Numerous shoppers explore these offerings to save money on essential items and impulse buys, and a Walmart credit card can generate additional financial perks.

Walmart Credit Card Options

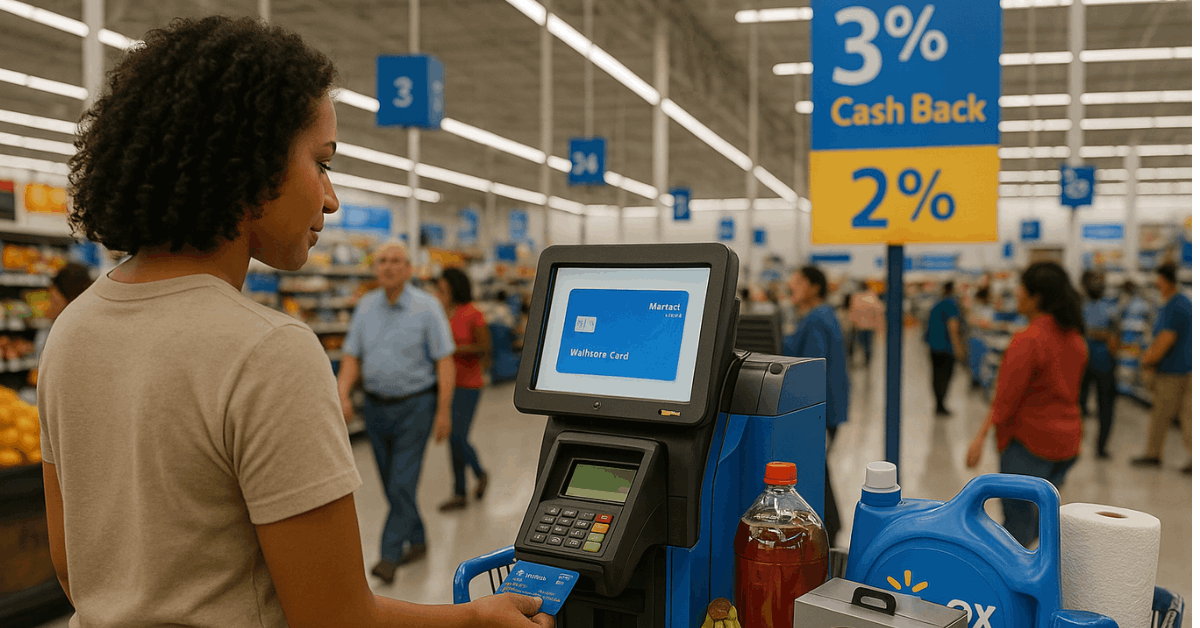

Walmart shoppers can choose between the Capital One Walmart Credit Card (powered by Mastercard) and the Walmart Rewards Credit Card (valid only at Walmart-affiliated locations).

Both cards offer no annual fee and varying reward structures. A decision depends primarily on whether a person prefers flexibility for worldwide use or a dedicated store card specifically intended for Walmart-only purchases.

Capital One Walmart Credit Card

The Capital One Walmart Credit Card is a versatile option operating on the Mastercard network.

Acceptance extends beyond Walmart’s walls, making it valid worldwide at any merchant that processes Mastercard transactions. Its rewards structure breaks down into clear tiers:

- 5% cashback on purchases made through Walmart.com or the Walmart app, including pickup and delivery orders.

- 2% cashback on Walmart in-store purchases, restaurants, and fuel from partner stations.

- 1% cashback on all other eligible everyday transactions.

Additional perks include travel insurance, extended warranty protection on select items, and concierge services for those who qualify.

Since approval often requires a fair to excellent credit score, applicants might need to confirm that their credit history aligns with the issuer’s requirements.

Walmart Rewards Credit Card

Those who shop exclusively at Walmart and want a simple way to accumulate savings may consider the Walmart Rewards Credit Card, which focuses on Walmart-specific spending.

This card offers no annual fee, similar to its counterpart, but can only be used at:

- Walmart locations

- Walmart.com

- Sam’s Club stores

- Associated gas stations under the Walmart or Murphy USA brand

The rewards structure includes 5% cashback on eligible online purchases (including the Walmart app) and 2% cashback for in-store spending at Walmart, along with designated gas stations.

Some categories, such as Sam’s Club purchases, may earn around 1%. Individuals who receive this card might have a lower credit score at the time of application or simply prefer a store-based card with straightforward rewards.

Advantages of Using a Walmart Credit Card

Walmart credit cards offer perks beyond earning rewards, such as fraud protection, extended warranties on specific transactions, and the absence of an annual fee.

Those who frequently shop worldwide for essential items can find additional value through the cashback system and related bonuses.

Cashback Rewards

Individuals who place online orders, such as grocery pickup and delivery, receive the highest percentage of cashback on many card options. This structure is beneficial for households purchasing groceries on a regular schedule.

Consistent online grocery orders might result in substantial savings over the course of a year. The 2% tier also applies to in-store purchases on many Walmart credit card options, which further helps when people shop physically in global Walmart locations.

Special Financing for Larger Purchases

Some Walmart credit card promotions introduce special financing periods on significant transactions, meaning no interest accrues if the total is paid in full within an allotted timeframe.

This feature can aid in budgeting for large-ticket items, provided timely payments are made and the terms are fully understood.

Missing a payment or failing to clear the balance by the end of the promotional period can lead to interest charges based on the full amount.

No Annual Fee

In an environment where certain reward-based cards impose yearly fees, Walmart credit cards are no-cost options.

That allows cardholders to maintain an account year-round without worrying about an annual charge diminishing the net rewards or savings.

Protection Benefits and Security

Walmart credit cards often include various protections that bring peace of mind. Zero-liability policies for fraudulent transactions help cardholders avoid unwarranted charges if the card information is compromised.

Some variations of the card also provide extended warranties on specific items for an additional time, along with balance protection plans in cases of severe financial hardship.

That can provide security beyond standard warranties and help in challenging circumstances.

Eligibility Requirements for a Walmart Credit Card

Anyone applying for a new credit account should ensure that basic requirements are satisfied before beginning the process. Lenders typically consider credit history, current financial situation, and other personal details to determine approval.

Age and Residency Status

Applicants must generally be at least 18 years old, although some regions impose a minimum age of 19. A valid residential address and documents verifying residency status are typically required during the application.

Walmart credit card issuers usually require that the address and personal details align with local regulations.

Credit Score and Income Considerations

A fair to excellent credit score typically increases the likelihood of approval, particularly for the Capital One Walmart Credit Card, which has broader acceptance.

Individuals with limited credit history or lower credit scores might be offered the Walmart Rewards Credit Card, which focuses on in-store usage.

Demonstrating steady income is also beneficial, since issuers want assurance that new cardholders can handle monthly obligations responsibly.

Step-by-Step Guide: How to Apply for a Walmart Credit Card Online

Completing a Walmart credit card application online is usually a quick process. Having key documents ready and adhering to the correct steps helps minimize potential delays.

Online submissions allow shoppers worldwide to attempt this process conveniently.

Access the Official Website

Prospective applicants should navigate to Walmart’s official website, where the credit cards are prominently displayed.

Clicking the credit card section typically provides access to an “Apply Now” button. Selecting that option leads to a secure application form. Reading the preliminary details ensures that the chosen card aligns with personal needs.

Gather Required Information

A smooth application process starts with assembling pertinent data beforehand. This information might include:

- Full legal name and current address

- Social Security Number or equivalent (depending on location)

- Employment details and current income sources

- Contact information, such as an email address and phone number

Applicants who have up-to-date financial documents and personal identification ready can fill out the form without interruptions.

Complete the Application Form

The online form prompts users to enter personal, financial, and employment details. Accuracy is essential because omissions or typos can delay processing or lead to verification requests.

Once all fields are filled, individuals should review the application carefully and confirm that each piece of data is correct.

The next step is to agree to the terms and conditions, which outline crucial information about interest rates, fees, and credit reporting.

Submit and Wait for a Decision

After double-checking the information, clicking “Submit” sends the application to the issuer for evaluation.

In many cases, the system provides an immediate decision. At times, additional verification is needed, causing a short delay. If the application is approved, a confirmation notice will appear.

Applicants often receive an email explaining the approval status. Not approved sometimes get instructions about next steps or alternative card offers.

Approval Process and Next Steps

A newly approved cardholder should monitor their mailbox for the physical card. Depending on the location, this delivery can take several business days.

Once the card arrives, an activation step is necessary, which is usually completed online or through a dedicated phone number. Activation instructions are generally included with the new card.

Card Delivery and Activation

When the card arrives, removing any protective stickers reveals the relevant details needed for activation.

Cardholders can set up an online account through the issuer’s portal, which provides options for activating the card, reviewing statements, and making payments.

After activation, the card is ready for worldwide usage (in the case of the Mastercard version) or restricted store usage (in the case of the store-only card).

Setting Up Online Account Access

Logging into the issuer’s website or app allows cardholders to track purchases, view accrued rewards, and schedule payments.

Setting up alerts for due dates, payment confirmations, and account balances helps cardholders remain on top of their responsibilities.

Enabling notifications can also detect unusual transaction activity, prompting immediate contact with customer service if necessary.

Interest Rates and Potential Fees

Responsible credit card usage requires an awareness of the possible fees and the annual percentage rate (APR).

Paying off the statement balance each month typically avoids interest charges. However, carrying a balance past the grace period incurs interest based on the stated APR.

Typical Purchase APRs

Numerous Walmart credit card products feature a standard purchase APR around 21.89%, though exact figures may differ based on the applicant’s creditworthiness and the issuer’s policies.

When budgeting, individuals who decide to carry a balance should factor in these interest costs. Keeping monthly balances as low as possible helps minimize finance charges.

Cash Advances and Balance Transfers

Cash advances often have a higher APR, sometimes around 22.97% or more. This type of transaction typically includes an additional fee, and interest starts accruing from the day the advance is taken.

Balance transfers, if offered, might carry a rate similar to cash advances. Verifying the specific terms is essential because these transactions can become costly.

Late Fees and Other Charges

A missed or late payment might generate a penalty fee, added to the balance owed. Some cards also charge foreign transaction fees for purchases made outside one’s home region or in a different currency.

The good news is that many Walmart credit cards do not levy an annual fee. Reviewing the credit agreement clarifies which charges may arise and helps prevent unwelcome surprises.

Conclusion

A Walmart credit card is ideal for frequent shoppers, offering cashback rewards and no annual fee. The Capital One version works anywhere Mastercard is accepted, while the Walmart Rewards card is for Walmart-only purchases.

Applying is simple—just prepare your documents, meet credit score requirements, and submit online.

Once approved, activate the card and use it responsibly to maximize rewards. By paying on time and taking advantage of cashback tiers and promotions, users can avoid fees and maximize their card benefits.