In daily shopping, flexible payments smooth cash flow without adding hidden complexity when used correctly.

Split Purchases in 4 With Klarna App describes a clear path to divide eligible orders into four interest-free installments while keeping control over timing and fees.

For consistent results, match eligibility requirements, understand where Pay in 4 is supported, and confirm the exact schedule before confirming any order.

What “Pay in 4” Really Means

In Klarna’s Pay in 4, each purchase breaks into four equal payments collected automatically every 14 days.

The first installment typically posts when the merchant ships the order, followed by three scheduled payments until the balance reaches zero.

Interest does not accrue when every installment is paid on time, and the plan closes automatically after the fourth charge settles. Late activity can trigger fees, reduce future spending power, or limit access to additional Klarna options.

Klarna Pay in 4 Eligibility

A short orientation prevents approval surprises and helps avoid failed checkouts.

For U.S. shoppers, Pay in 4 requires being at least eighteen and a resident of the United States or its territories, having full legal capacity to contract, and providing accurate personal details.

Many accounts require a valid Social Security Number and a linked card or bank account to verify identity and complete payments securely.

Core Requirements

Eligibility includes a U.S. residency requirement, legal age of majority, and the ability to receive security verification codes via text message.

A current debit card, credit card, or bank account is needed for autopay, and personal details must match official records.

Klarna evaluates prior usage, on-time history, and order amount at checkout, so approval remains purchase-specific rather than permanent.

Where Pay in 4 is Available

Service availability is nationwide except for Hawaii and most U.S. territories; Puerto Rico remains supported, while APO/FPO/DPO addresses are excluded.

International availability varies by market and product, so check the app’s store directory and local terms when traveling or shopping cross-border.

Klarna purchase power appears in the profile as an estimate only and refreshes based on recent behavior, amounts, and repayments.

Identity and Verification

Soft identity checks often occur for Pay in 4, Pay in 30 days, Pay over time, and when applying for a Klarna card, using credit-bureau data to verify details and assess risk.

TransUnion typically supports these checks in the United States, and soft inquiries do not affect FICO or VantageScore. Missed payments can still impact creditworthiness over time by limiting access to financing options or reducing approved spending power.

How Pay in 4 Works

A brief checklist keeps the flow clear and reduces errors at checkout.

- Choose Klarna at checkout in a participating store and select Pay in 4 for eligible carts.

- Confirm the shipping address, payment source, and identity prompts, then review the installment schedule before submitting.

- Make the first payment at shipment; the remaining three payments occur automatically every 14 days.

- Track the plan in the app, enable reminders, and prepay anytime if earlier closure fits your budget.

- If an installment fails, monitor the retry attempt and resolve issues quickly to avoid fees and plan disruptions.

Paying Almost Anywhere: Cards, Wallets, and the App

Many brands present Klarna natively at checkout; others can still be reached using platform tools. Apple Pay and Google Pay can route eligible purchases through Klarna online or in-app, where supported, extending wallet convenience to installment plans.

The Klarna Credit Card lets cardholders shop anywhere Visa is accepted and then choose how to repay according to Klarna’s terms. A Klarna one-time card can also split an eligible purchase at any merchant that accepts Visa, generating a single-use virtual card for that order from inside the app.

Across all methods, buyer protections remain active within Klarna’s policies, while merchant return windows continue to control refunds and exchanges. Cash-back offers may appear in the app for participating stores; activation rules and tracking can be impacted by cookie settings, ad blockers, or combining multiple promotions in the same session.

Costs, Late Fees, and Estimating Payments

Clear math helps avoid surprises and keeps the total cost visible before committing. Pay in 4, Pay in 30 days, and Pay in full today charge no interest when paid as agreed.

Pay over time uses monthly financing with an APR range typically between 0.00% and 35.99% based on creditworthiness and term length, and financing is issued by WebBank.

A missed Pay in 4 installment can trigger a late fee up to $7.00, with total late fees capped at 25% of the original order value.

Does Klarna Charge Interest?

Interest never applies to on-time Pay in 4 or Pay in 30 days schedules; monthly financing under Pay over time can carry interest depending on approval terms.

Plan disclosures provide the exact APR, payment count, and due dates, and prepayment can shorten the term without penalty when allowed. Using the in-app Klarna payment calculator gives a quick view of how costs change under different options.

Sample payment breakdown:

| Option | Payment pattern | Approx. payment | Total cost |

| Pay in 4 | 1 payment every 2 weeks | $750.00 × 4 on a $3,000 order | $3,000.00 |

| 6 months at 19.99% APR | Equal monthly payments | $529.56 | $3,177.33 |

| 12 months at 19.99% APR | Equal monthly payments | $277.89 | $3,334.67 |

Estimates shown are illustrative examples, not offers of credit, and actual terms depend on approval, taxes, shipping, and merchant timing. Late activity can add fees and may reduce access to future plans until the account returns to good standing.

Checking Schedules, Rescheduling, and Avoiding Misses

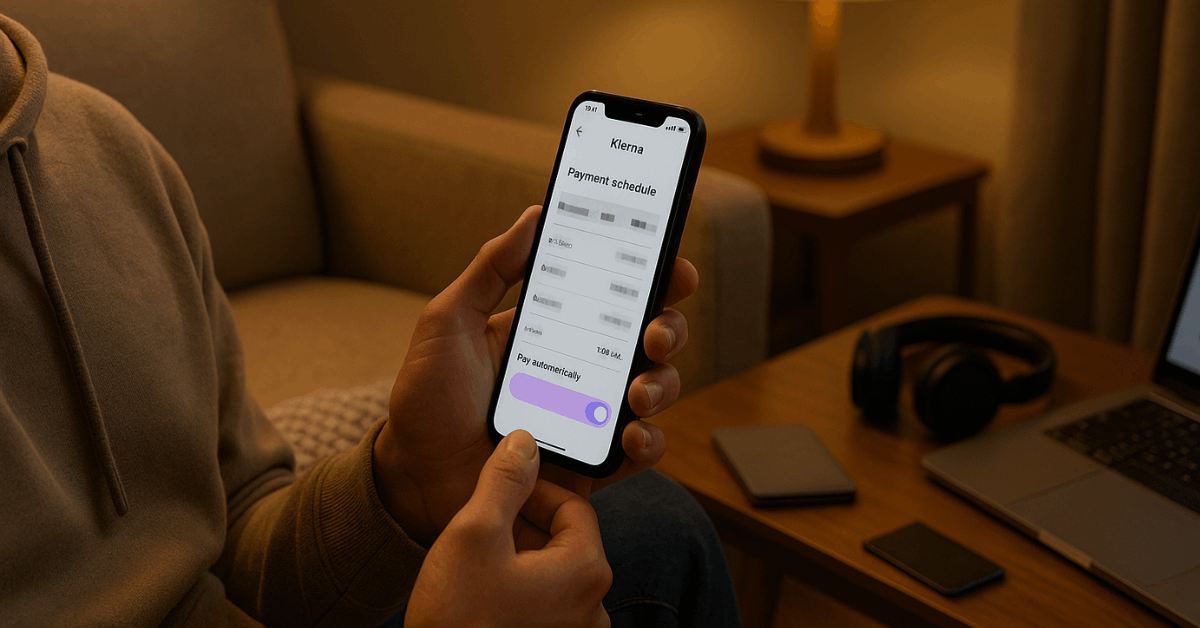

Payment schedules live inside the Klarna app and on the web profile, showing order details, installment dates, and amounts due.

Enabling in-app notifications and email reminders helps prevent accidental misses when travel, card replacements, or bank changes occur. Some plans allow limited rescheduling directly in the app; otherwise, contacting customer support early increases the chance of a sensible accommodation.

Keeping the funding card valid, maintaining sufficient balance on due dates, and resolving declines quickly protects future approvals.

Credit Checks, Credit Impact, and Prequalification

Responsible use depends on understanding how approvals are made and when checks occur.

Soft checks typically support Pay in 4, Pay in 30 days, Pay over time, and Klarna card applications, and soft inquiries do not affect credit scores or appear to other lenders.

Signing up for an account and downloading the app do not trigger a credit check. Prequalification helps set expectations without affecting the score, though final approval still occurs at purchase based on real-time risk signals.

Klarna Soft Credit Check

Soft inquiries pull limited credit-file data to validate identity and evaluate recent payment behavior, usually through TransUnion in the U.S.

A soft pull differs from a hard inquiry because it does not change your score and remains invisible to other creditors.

Missed payments can still undermine future Klarna approvals, reduce purchase power, and raise the risk score calculated at checkout.

When a Check Does Not Occur

Basic account creation and app installation do not generate a bureau inquiry. Profile updates, preference changes, and browsing merchant offers also proceed without credit pulls, keeping background activity separate from financing decisions.

Plan approvals remain transaction-specific, so historical approvals never guarantee future results at different amounts or merchants.

Late Payment Consequences

Unresolved missed installments can add fees, reduce account standing, and curtail access to additional options until repayments catch up.

Repeated issues may lower purchase power estimates or lead to declined transactions at checkout. Setting autopay, enabling alerts, and keeping a backup payment method on file provides redundancy for time-sensitive obligations.

Safety, Privacy, and Account Controls

Security design keeps card details out of merchant hands through tokenization, encrypted transport, and secured processing environments.

Stores never receive the raw card number used for Klarna payments, and all transactions run over secured connections that meet strict protocols.

Linked cards and bank accounts can be removed at any time inside profile settings, and buyer protection policies support issue resolution for eligible purchases.

Practical Tips for Global Shoppers

In non-U.S. markets, product names and availability can vary, though the core “split into installments” concept remains the same. Checking local terms in the app avoids region-specific surprises, including address restrictions and unsupported categories.

Large orders benefit from reviewing purchase power beforehand and confirming the shipment timing, since the first installment typically posts at dispatch rather than at order placement.

Maintaining low revolving balances, paying every installment on the scheduled date, and clearing financed plans early when possible help keep overall costs down across wallets, cards, and apps.

Common Pain Points and Quick Fixes

Card changes after a bank reissue can cause automated charges to fail unless the new card replaces the old one inside the app.

Travel across time zones occasionally leads to reminders arriving at inconvenient hours, which a quick notification settings review can normalize.

Merchant returns can take time to flow back through the system, so saving receipts and tracking emails speeds resolution if a refund needs manual attention. Late-fee exposure drops substantially when reminders remain active and a small buffer sits in the funding account on the due date.

When Fees Apply and How to Prevent Them

Missed Pay in 4 installments can incur a fee of up to $7.00, and the sum of all late fees on a single order can never exceed 25% of that order’s value.

Monthly financing under Pay over time can include interest based on APR, term length, and approval factors documented during checkout. Early action matters most; resolving an unsuccessful attempt before the second retry prevents fee assessments entirely and keeps the account standing healthy for future purchases.

Regularly revisiting Klarna purchase power, reviewing upcoming due dates, and using reminders keeps the overall experience smooth and cost-effective.

Conclusion

Used correctly, Klarna’s Pay in 4 spreads costs predictably without interest or surprise fees. Confirm eligibility, review the schedule, and keep autopay funded to protect approval and timing.

Monitor reminders, update payment methods after card changes, and handle returns inside app workflows. Consistent on-time payments maintain purchase power and keep flexible installments working across supported stores.