A Chase Personal Loan gives you quick access to funds for major expenses, from debt consolidation to home projects.

You get fixed monthly payments and competitive rates without needing collateral.

This guide explains how to apply, what’s required, and how to manage your loan effectively.

Overview of Chase Personal Loan

A Chase Personal Loan is designed for customers who want a simple, secure, and flexible way to borrow money.

It’s ideal for managing debt, funding big purchases, or covering emergencies with predictable payments.

- Loan Type: Unsecured personal loan available only to existing Chase customers.

- Loan Amount: Typically ranges from $5,000 to $50,000, depending on credit profile.

- Repayment Terms: Fixed terms with predictable monthly payments.

- Interest Rates: Competitive fixed APR, determined by credit score and financial history.

- Purpose: Can be used for debt consolidation, home improvement, or large purchases.

- Collateral: Not required; approval is based on creditworthiness and income stability.

- Accessibility: Apply online or at a Chase branch through your existing account.

Benefits and Features

A Chase Personal Loan gives you predictable financing with strong advantages for existing customers.

It’s designed to be simple, flexible, and cost-effective for personal financial goals.

- No origination fees: You won’t be charged to open or process your loan.

- Fixed monthly payments: Enjoy consistent payments throughout the term.

- Quick approval: Existing Chase customers can receive faster decisions.

- Autopay discount: Save on interest by enrolling in automatic payments.

- No prepayment penalty: You can pay off the loan early without extra charges.

- Flexible terms: Choose repayment periods that fit your budget and timeline.

- Online and in-branch access: Apply and manage your loan using Chase Online Banking or visit a local branch.

Eligibility Requirements

To qualify for a Chase Personal Loan, you need to meet specific customer and financial criteria.

These requirements ensure you can manage repayments responsibly and maintain a strong borrowing record.

- Existing Chase account: You must already hold a Chase checking or savings account.

- Credit score: A good to excellent credit history is usually required for approval.

- Income verification: Proof of steady income or employment must be provided.

- Residency: Applicants must be U.S. citizens or permanent residents.

- Age requirement: You must be at least 18 years old at the time of application.

- Debt-to-income ratio: Should meet Chase’s internal lending standards to show repayment ability.

- Valid identification: A government-issued photo ID is required for verification.

Step-by-Step Application Process

Applying for a Chase Personal Loan is simple and can be done online or at a local branch.

Follow these steps carefully to ensure your application is complete and processed quickly.

- Log in to your Chase account using online or mobile banking access.

- Check for prequalified offers based on your existing relationship with Chase.

- Select your loan amount and repayment term according to your needs and budget.

- Provide personal and financial details, including income and employment information.

- Review the terms and conditions before submitting your application.

- Submit your application and wait for Chase to process it—usually within one or two business days.

- Receive approval and disbursement directly into your Chase account once confirmed.

Interest Rates and Fees

Chase offers clear loan pricing with fixed rates and minimal fees. Understanding these terms helps you accurately estimate your total repayment cost.

- Fixed APR: Rates are determined by your credit score, income, and loan amount. They remain constant for the entire term.

- Rate Discount: You can receive a lower APR when you set up automatic payments (autopay) from your Chase account.

- No Origination Fee: Chase does not charge any setup or processing fees, keeping borrowing costs low.

- No Prepayment Penalty: You can pay off your loan early without any additional charges or penalties.

- Late Payment Fee: A fee applies if you miss or delay a payment, depending on your agreement terms.

- Transparent Terms: All interest and fee details are clearly shown during the application process for full transparency.

Loan Uses and Flexibility

This personal loan can be used for many financial purposes, giving you flexibility to manage life’s major expenses.

It’s ideal for both planned and unexpected costs that require fast funding.

- Debt Consolidation: Combine multiple debts into a single fixed monthly payment at a lower overall rate.

- Home Improvement: Finance repairs, upgrades, or remodeling without tapping into home equity.

- Medical Expenses: Cover unexpected hospital bills or treatments with manageable payments.

- Major Purchases: Fund appliances, furniture, or travel plans through structured repayment terms.

- Education Costs: Help pay for training, certification, or tuition-related expenses when other aid isn’t available.

- Emergency Fund Support: Access quick cash for urgent financial needs without using high-interest credit cards.

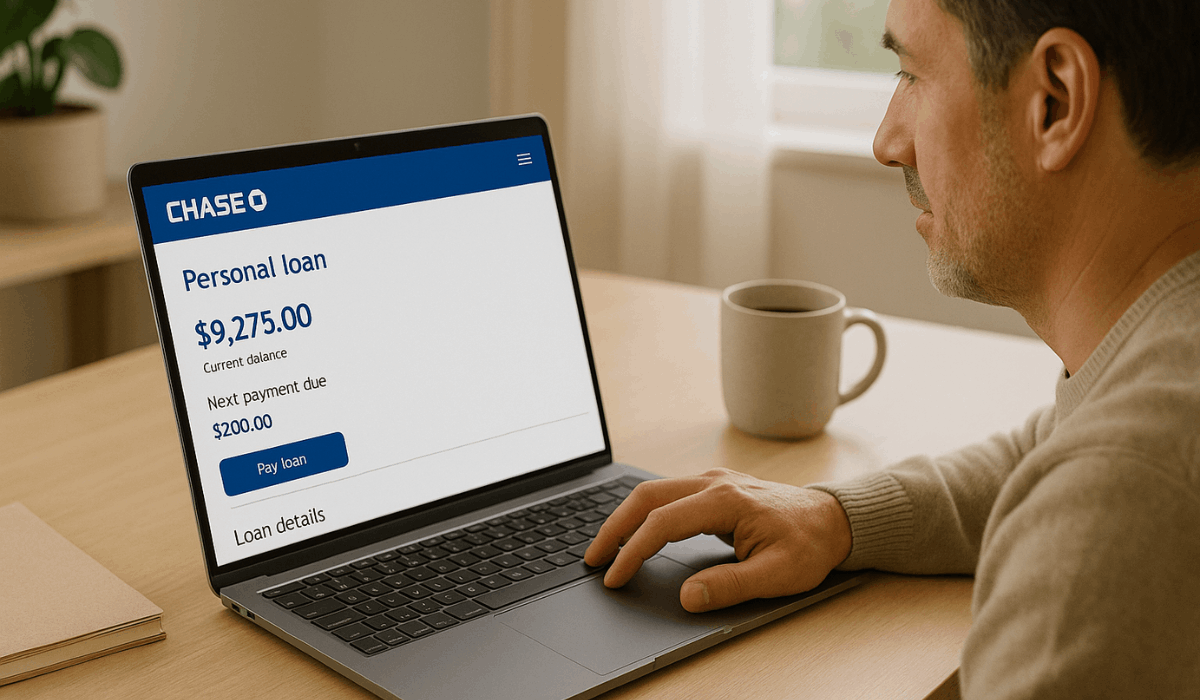

Managing Your Loan Effectively

Once your loan is approved, managing it well ensures smooth repayment and strong financial control.

Staying organized helps you maintain a good credit standing and avoid missed payments.

- Use Chase Online Banking: Track your loan balance, payment history, and remaining term anytime.

- Set Up Autopay: Enroll in automatic payments to avoid late fees and qualify for rate discounts.

- Monitor Due Dates: Mark your payment schedule in a calendar or app to stay consistent.

- Review Statements Regularly: Check for correct payment posting and any interest changes.

- Plan for Early Payoff: If possible, pay extra toward your balance since there’s no prepayment penalty.

- Contact Support Promptly: If you face financial difficulties, reach out to Chase Customer Service for assistance or payment options.

How to Improve Your Approval Chances

Boosting your chances of getting approved for a Chase Personal Loan depends on preparation and financial stability.

Following these steps can help you qualify faster and secure better terms.

- Check your credit report: Review your credit history for errors and improve your score before applying.

- Pay down existing debt: Lowering your debt-to-income ratio makes you appear more creditworthy.

- Maintain steady income: Ensure you can provide recent pay stubs or proof of income to show reliability.

- Apply for a realistic amount: Choose a loan size that aligns with your income and repayment ability.

- Use autopay: Opting for automatic payments not only prevents missed dues but may also lower your APR.

- Keep your Chase account active: Regular account use helps establish trust and strengthens your banking relationship.

Contact and Support Information

You can reach Chase Bank through verified customer service channels for help with your personal loan or account inquiries.

Always use official Chase resources to keep your information secure.

- Official Website: Access the Chase homepage to manage your loan, check updates, or locate nearby branches.

- Customer Service (Personal Banking): Call 1-800-935-9935 for general banking or personal loan assistance.

- Credit Card and Loan Support: Contact 1-800-432-3117 for loan or credit-related concerns.

- Branch Support: Visit any Chase branch to apply in person or speak directly with a financial representative.

- Operating Hours: Phone assistance is available Monday to Friday, 8 AM–8 PM ET, and Saturday, 9 AM–6 PM ET.

- Mobile Access: Use the Chase Mobile App or online account portal to message support and manage your loan securely.

Final Takeaway

A Chase Personal Loan gives you a predictable and straightforward way to handle significant financial needs.

You get fixed payments, flexible terms, and no hidden fees—all backed by Chase’s trusted service.

Apply today through Chase Online Banking or at your nearest branch to start your loan application with confidence.

Disclaimer

Loan terms, rates, and eligibility requirements may change without prior notice. Always verify the latest information directly with Chase Bank before applying.